Finance & Money#Tag

We help you with tried and tested real-life money management and finance tips and tricks.

Investing in stocks or saving money using high yield bank accounts – We share our experience on what helps make more money without the tensions of losing and depreciation.

Indian NRE/NRO accounts and their benefits vs keeping money in USA, Australia or Canadian bank savings accounts.

Is Buying gold better than keeping money in Savings account?

#Finance & Money

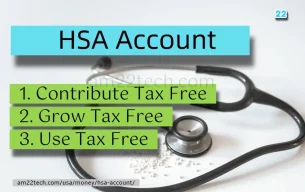

HSA Account is Tax-Free Money, Invest in Stocks, Use for Medical Anytime

AM22Tech Team 20 Mar, 24

#Finance & Money #iphone

Send iPhone USA to India, Custom Duty, GST Tax Calculator

AM22Tech Team 20 Mar, 24

#Finance & Money #NRI

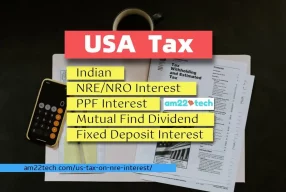

How to file US Tax on NRE, NRO Interest (without 1099-INT)

Anil Gupta 10 Mar, 24