What is CTC? Difference between CTC Package and Net Salary?

CTC full form is Cost To Company. It means total salary package & benefits received by employee in a year including free meals, cabs, interest free loans.

CTC means Cost To Company in India. CTC package is a term often used by private-sector Indian and South Indian companies while making an offer of employment to show the total remuneration.

The gross salary before income tax and other deductions is what is listed as Cost To Company salary for a period of 12 months in a financial year.

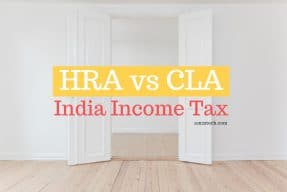

The CTC package shows a detailed break-up showing basic salary, HRA (House rent allowance), and other such allowances.

Please note that CTC contains all monetary and non-monetary amounts spent on an employee.

CTC in a resume is generally asked to be filled in, to help the new employer know your current total gross salary (including any cash or non-cash benefits).

Take-home pay (known as in-hand salary in India) is the net salary after deducting income tax (TDS – tax deducted at source in India) and other deductions, from the gross monthly pay.

Use Take Home Salary Calculator – India to make a decision of accepting the new job offer or not by looking at your monthly in-hand earnings and deductions.

Do not just look at the figure of CTC as there could many components which may be misleading and may NOT form part of your monthly take-home.

This article will discuss:

CTC Contents

A Sample Cost to Company package of 14 lakhs in Karnataka, India with take-home pay of 93 thousand per month:

CTC = Direct benefits + Indirect benefits + Saving Contributions

in-Hand Salary = Direct Benefits – Income tax – Employee PF – Other deductions, if any

| Direct Benefits | Indirect Benefits* | Saving Contributions* |

| Basic Salary | Interest free loans, if any | Superannuation |

| Dearness Allowance (DA) | Food Coupons / Subsidized meals | Employer Provident fund |

| Conveyance allowance | Company Leased Accommodation | Gratuity |

| House Rent Allowance (HRA) | Medical/Life Insurance premiums paid by employer | |

| Medical allowance | Income tax savings | |

| Leave Travel Allowance (LTA) | Office Space Rent | |

| Vehicle Allowance | ||

| Telephone / Mobile Phone Allowance | ||

| Incentives or bonuses | ||

| Special / City Compensatory allowance etc. | ||

| * Monetary value added to CTC |

Cost to Company Direct benefits

Paid to employee monthly and form part of your take-home (in-hand salary) after deducting income tax plus any additional state taxes.

CTC Indirect Benefits

Benefits (also called Perquisites in legal Indian government terms) that an employee enjoys without paying for them. Your company takes care of them but add their monetary value to your CTC.

Off-course it is an expense for the company and hence, could be added to CTC.

1. Interest free loans, if any in CTC

Banking companies like ICICI allow their employees to get car/home loans at highly subsidized rates and then add the amount equal to the difference between the market and subsidized interest rate to employee’s CTC.

The interest that you did not pay (actually saved using a subsidized rate) is a benefit for you!

If you don’t take the loan, you won’t get this benefit, but it is anyway added to your CTC. Be careful while accepting the offer letter.

NOTE: The differential amount of benefit i.e. the money you save with a subsidized rate of interest is taxable. It depends on your company policy if they bear the tax or pass it on to you.

2. Food Coupons / Subsidized meals

Many MNC employers offer free lunch and evening snacks at the workplace. No lunch is free in this world.

On the other hand, the meal vouchers (or food coupons) help you save income tax too.

NOTE: Normally, you may not get this amount in-hand (as cash) even if you opt-out of eating in the employer’s cafeteria.

3. Company Leased Accommodation (CLA)

Your employer might provide you with company paid accommodation or pay rent to the landlord directly, saving you from the tension of finding a home and negotiating on rent deals.

The monetary value of CLA, that’s taxable, is added to your CTC, which is normally the rent and furniture cost.

4. Medical, Life Insurance premiums paid by company

Group medical and life insurance policies by your employer give you much better and comprehensive cover over the individual ones.

The cost is added in CTC and you can claim it for income tax rebate while filing ITR.

You will never be asked to pay a premium but in reality, you would have paid it as part of the group plan bought by your employer.

5. Free Cabs / Taxi for Office commute

You would be lured to a new job with the option of FREE transportation to the office. It is not really free even if it is subsidized.

Most employer’s would add it to your salary package (CTC).

Free or subsidized transport is still taxable either as FBT (Fringe Benefit Tax) paid by the employer or as your income tax if the employer passes it on to you.

6. Income tax savings

Sometimes companies offer you some benefits which are tax-free for you but are taxable to them.

Example:

If you receive per diem allowances, they are subjected to FBT (Fringe benefits tax). It is supposed to be paid by your employer and not you.

Some companies do add the value of FBT in your CTC, that you, as an employee would be liable to pay if your company does not pay it.

FBT tax-saving added to CTC is a virtual amount that you will never receive in your hand.

Related: Unspent Per Diem Allowance Received Abroad Are Taxable In India

7. Office Space Rent

You must have heard about FAT pay packages (several crores for a fresher) that IIM (Indian Institute Of Management) or IIT (Indian Institute of Technology) graduates receive.

A deep look at their break-up of CTC would reveal the work cubicle rent too.

Example:

If the company is spending INR 7000 per month on the cubicle that you would sit in at your work location, they would add the yearly rent in your CTC.

Your work location rent is also part of FAT CTC packages.

Employee Retirement Saving Contributions

Payments made to your long term savings account by your employer.

1. Superannuation

A pre-defined amount is contributed every month in your superannuation account, mostly offered by multinational companies as a way of saving for retirement.

You can withdraw it after you retire or at the time of leaving the organization.

Most employers do not directly give you cash on separation though. You get the option of converting the amount into some kind of insurance policy.

2. Employer Provident fund Contribution

Most employers contribute 12% (called PF) of basic salary every month to employee’s Provident fund account, shown in CTC. An employee also contributes 12% (called VPF).

Difference between Employer PF, Employee PF (Called VPF) and PPF.

Employer PF is part of CTC not shown on Salary Slip. It is NOT counted as part of your earnings and hence not taxed.

3. Gratuity is part of CTC

Paid @4.81% of total yearly basic salary, per Indian tax law, with no withdrawal allowed before 5 years.

If you leave the organization anytime before 5 years, you lose your Gratuity accumulation.

Make sure you serve a company for at least 5 years to claim your Gratuity.