HRA is a component of the salary package which the company issues you monthly whereas CLA is not part of your monthly take home. Normally, a company gives you a choice to decide which way you want to go.

If you opt for HRA, you need to take care of your accommodation, rent, and other things. In the case of CLA, the company provides you accommodation and you need not worry about it.

But the major factor that differentiates the two is the income tax that is charged on these options. Please read on to find out.

HRA is an allowance that is added to your salary and is tax-exempt to a certain extent (as per IT rules) whereas CLA is treated as a benefit that is given by the company to an employee and is taxable in the hands of the employee. i.e. you as an employee are liable to pay income tax on the perquisite value of the house.

The perquisite value of the house is simply added to your net income and is taxed as per the applicable slabs.

The amount shown as a company leased accommodation is generally the amount that your company will spend on the house that they will provide you.

As this is an expense which your company is making on you, they show it as part of your CTC (Cost To Company).

But as you are getting rent-free accommodation, you don’t need to pay rent and hence is a kind of virtual addition to your monthly take-home pay which never reaches your hands!

This article will discuss:

How to calculate the perquisite value of the house under CLA?

1. Calculate Your Total Salary for the year

Salary here includes following:

- Basic salary

- Dearness Allowance (DA) (Forming part of Superannuation benefits). If nothing is mentioned, then add full DA.

- All Allowances to the extent they are taxable including conveyance allowance.

- Any Commission

- Any Other Fees

- Any Other payments like bonus or en-cash of leaves.

What should NOT be added to salary above:

- Employer’s contribution to PF (provident fund).

- Allowances which are exempted from tax.

- The value of perquisites like any electricity bills or phone bills paid by employer.

- Payments made for medical benefits/health insurance premium.

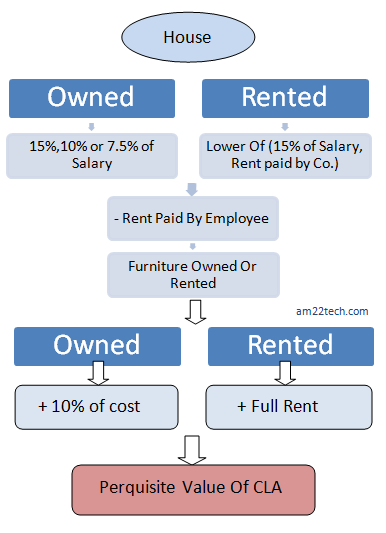

2.A. House is owned by your company? – YES

If the house is owned, the perquisite value of the house would be:

15% of salary (in cities that have a population exceeding 25 Lakhs as per the 2001 census)

OR 10% of salary (in cities that have a population between 10 Lakhs and 25 Lakhs as per the 2001 census)

OR 7.5% of salary (in all other places)Less (Subtract) The portion of the rent actually paid by you (Employee)

2.B. House is leased/rented by your employer? – YES

If your employer provides you accommodation that is in turn rented/leased by it, the perquisite value of the house would be:

The lower of: The actual amount of lease or rent paid by the employer OR 15% of salary Less (subtract) The portion of the rent actually paid by you

3. House is furnished? – YES

It is Furnished house if it has one or more of the following provided to you by company:

3.A. House is Owned by your Company? – YES

For a company-owned house, add to the above-calculated value:

– 10% of the original cost of the furniture (if the furnishings are owned by the employer)

OR – The actual hire/lease charges paid by the employer (if the furnishings are hired by the employer)

3.B. House is Rented by your Company? – YES

For a Rented house, add to the above-calculated value:

– 10% of the original cost of the furniture (if the furnishings are owned by the employer)

OR

– The actual hire/lease charges paid by the employer (if the furnishings are hired by the employer)Please note that when the house is rented by the employer, the city in which it is located would not matter in the calculation of its perquisite value.

Once you are done with the above values, follow this example to calculate your perquisite value:

Company Leased Accommodation Perquisite value Example Calculation

Lets assume that you have the following components in your salary:

| Basic Salary per annum | 1,80,000 |

| Dearness Allowance (DA) per annum | 72,000 |

| Conveyance Allowance per annum | 20,000 |

| Entertainment Allowance per annum | 30,000 |

| Performance bonus per annum | 40,000 |

Now, we will calculate the perquisite value of the house under following cases:

- House is owned by company/employer and furniture cost is Rs. 20,000

- The population of the City is 30 lakhs

- The population of the City is 24 lakhs

- House is NOT owned by company i.e. it is rented or leased and pays Rs. 45,000 per annum as rent. Also, the house is furnished and the company is paying Rs 45,000 per annum for furniture.

NOTE: The company also charges a nominal rent from the employee @ Rs. 2000 per month.

- Calculate total yearly salary:

Basic (1,80,000)

DA (72,000)

Conveyance Allowance: Since 800 per month is tax exempt, only 20,000 – 9600 (800*12 months) = 10,400 needs to be added.

Entertainment allowance (30,000)

Performance bonus (40,000)

TOTAL = Rs. 3,32,400 - Perquisite Value of House

Case 1(1) Case 1(2) Case 2 Validation Rule 15% Salary 10% of Salary Lower of 15% of Salary or Actual rent paid by Company Portion of Salary 49,860 33,240 45,000 – Actual Rent paid by employee (if any) 24,000 24,000 24,000 Furniture Rule 10% of Cost 10% of Cost Rent paid for furniture Furniture Value 2,000 2,000 24,000 Perquisite Value 27,860 11,240 45,000

Hence, the perquisite value as calculated above would be added to your taxable income and taxed according to your tax slab.

Exceptions to CLA perquisite rules

- Living/Occupying in the house does not matter

The company-provided accommodation is taxable as a perquisite even if you do not actually live in it. Thus, you need to take out the CLA (if any) from your package if you do not live in the house, else it would be considered as your perk, and you would need to pay income tax on it. - Hotel accommodation is also considered a perk

Even if the accommodation is provided in a hotel, it would be considered a perk. However, if the hotel accommodation is provided for 15 days or less at the time of transfer from one place to another, it would not be considered a perquisite. For hotels, perquisite value would be:

Lower of: 24% of the salary OR the actual amount paid to the hotel

Less (subtract) The rent actually paid by you - Government employees

If you are a government employee, the perquisite value of the house would be the license fee charged for such accommodation, less any rent actually paid by you. - Remote area locations

Certain accommodations, if provided in a “remote area”, are not considered as perquisites. These include mining sites, dam sites, power generation sites, oil exploration sites, project execution sites, etc.