DHS announced on Mar 9, 2021, that they will rollback the Public charge rule, and the provisions enacted during Trump’s era will not be implemented going forward.

USCIS will also issue the guidance with respect to the i-944 public charge form soon and the expectation is that it will be removed. This will be a big relief for people filing i-485 applications for Green cards.

The DHS will now start using the 1999 public charge policy which was quite open and not as restrictive as Trump admin’s policy.

The law as listed below will not be implemented going forward starting Mar 9, 2021:

This article will discuss:

Public Charge Rule (Trump Time)

On Feb. 24, 2020, USCIS implemented the Inadmissibility on Public Charge Grounds final rule nationwide, including in Illinois.

The new public charge rule will judge your eligibility for green card based on your age, health, financial status and education.

11 states have filed a lawsuit to block this regulation at this time.

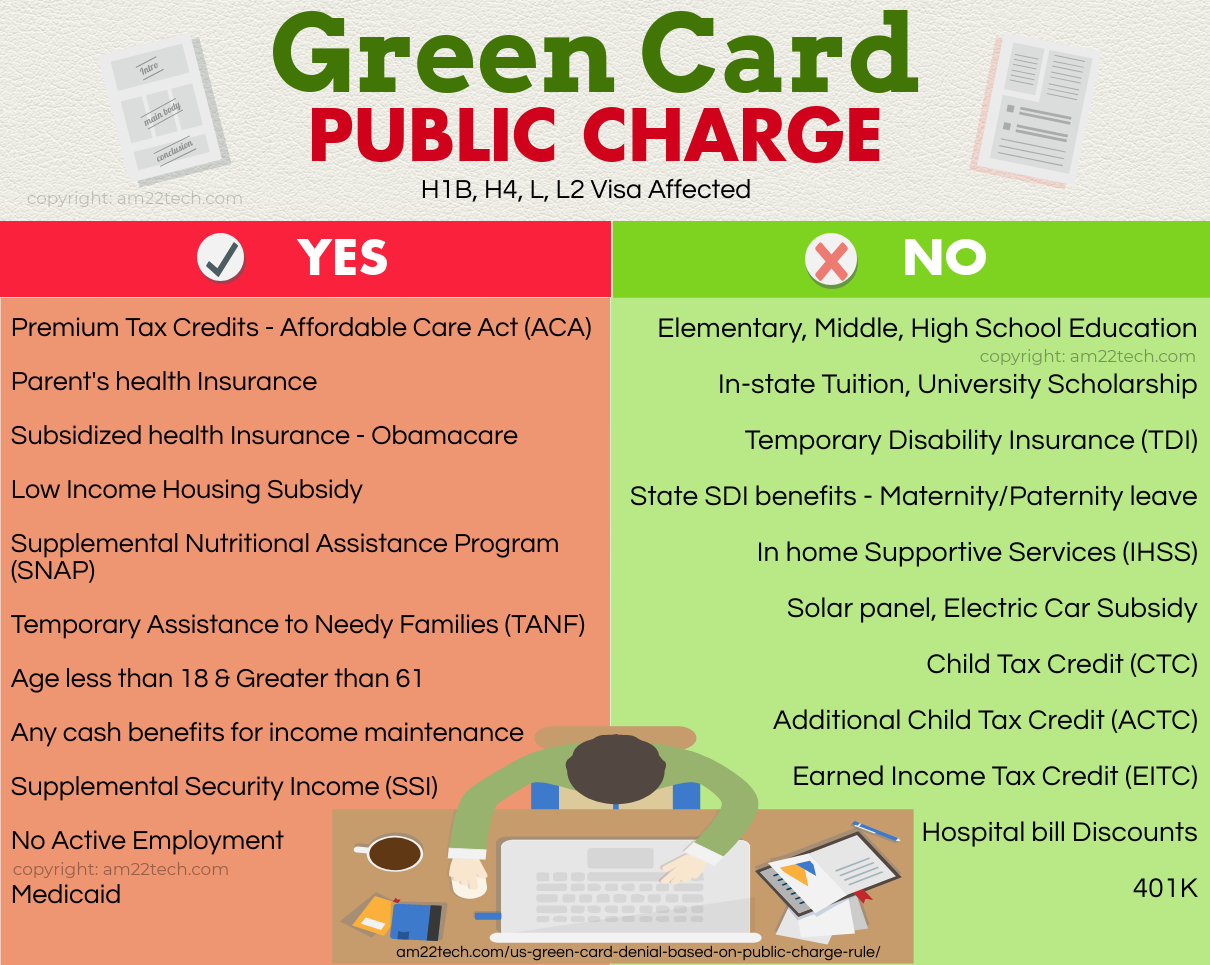

This new rule does not apply to US citizens but will be applicable for H1B, H4, L1, L2, B1, B2, O1, O3, TN, TD, E visa workers applying for visas at the US embassy or extending status or filing adjustment of status.

Trump also announced the mandatory non-subsidized health insurance requirement for immigrant applications filed at the US embassy starting Nov 3, 2019.

The current pending applications will not be affected by this new rule.

- If you use any public benefit for more than 12 months in total in the last 36-month period OR

- Receipt of two benefits in 1 month counts as 2 months.

If you are expected to completely rely on government-paid benefits like Food Stamps or subsidized health insurance even when working in the US on an H1B visa, the new rule will:

- Not allow you to enter the US.

- USCIS will deny you visa extension or change of status applications.

Are H1B Visa Workers Affected?

The new rule is applicable for applications filed using form I-539 (commonly used for H4 extensions), Form I-129 (Commonly used for work-related visas like H1B, L, etc.)

The good news is that children studying in government public primary (elementary), middle and high schools are not considered a public charge. At this time, the subsidized food in school lunch is also not part of the rule.

As per my opinion, H1B and L visa workers will not be affected much as they already get health insurance from employers and are self-sufficient in managing their home expenses.

DHS added a new heavily weighted positive factor if you use private health insurance without any subsidies in the form of premium tax credits (including advance premium tax credits) under the ACA (Affordable Care Act).

Many people on H1B or L visas working for small IT consulting companies use the Obamacare healthcare platforms to buy health insurance and then claim the premium tax credits in their IRS tax return.

This new rule will count as a negative factor for your green card application. So, beware and try to buy private insurance without any government subsidy and preferably from an employer group insurance plan.

If you have used the health insurance subsidy, you can fix it as the USCIS officer will look at the past 36 months’ records to see if you are dependent on government benefits. If you are an Indian, you have enough time to change your plan and fix your records as your priority date might be decades away.

If you have used the Premium tax credit in past, you are still safe as the new rule’s application starts from Oct 15, 2019. If you are using the health insurance subsidies, we recommend stopping using them.

Hospital bill discounts or negotiated final payments do not count towards public benefit.

Parent’s Green Card Sponsorship

Family migration would certainly be affected if people apply for low income housing benefits which many of them do.

You will also have to buy private health insurance for parents to avoid public charge conditions along with filing form I-864 affidavit of support.

At this time, In-State Tuition and University Scholarship are not part of the public charge rule.

A simple rule to follow: If it’s federal help or subsidy based on your financial status, then it will be counted as a public charge.

Scholarships do not count though as they are based on merit and not financial status.

H4 EAD and L2 EAD are just the work permits to work in the USA. You are free to choose to work or not work after getting an EAD card. You should not use the subsidies though to get health insurance as that would count as a public charge.

In-home Supportive Services (IHSS) do not count as a public charge.

Need Help File Application?

Support

Use hassle-free visa extension and EAD filing service to file your application with USCIS

Visa status issues consultation includedQuick Service

Filed within 1-2 days if you have all the documents ready and uploaded

Emergency service availablePhoto

You click, we edit photos as per US visa requirements to remove background, align face and shoulders

Photo printing includedYou are fine as long as you can stop using the premium healthcare tax credit now and stop taking Obamacare Subsidies. The new rule starts from Oct 15 for new applications.

SDI benefits from State for Maternity and Paternity leave as we have in California are not part of public charge.

The temporary disability insurance (TDI) is mostly funded by the employee’s payroll deductions. They can receive benefits when they are temporarily unable to work due to disability, including pregnancy.

The tax credits claimed on your IRS tax return are legal and are not counted towards the public charge.

Earned Income tax Credit (EITC), Additional Child Tax Credit (ACTC), and Child Tax Credit (CTC) are excluded from the Public charge definition.

401k is your money and is not funded by the government. Don’t worry and do not think too much if you are reading this question 🙂

There is no mention of solar and electric cars like Tesla or hybrid car subsidies in the DHS rule for a public charge.

We assume that since these are promotional subsidies given by the government to promote the use of environment-friendly fuel, this will not be part of the public charge rule.

DHS Public Benefit Deciding Rules

USCIS will assign points for your application based on multiple factors.

Negative Points

#1 Age

If you are younger than 18 or older than 61, you are a negative point as you have high chance of using Medicaid.

#2 No Active Employment

If you cannot prove that you are employed or have been employed in the recent past, you will earn a negative point for your extension of status visa application.

#3 Health Insurance & Personal Assets

If you cannot buy your own health insurance or your assets are so low that they cannot pay for your healthcare, your Green card application will be denied.

Positive Points

#1 Age

Your application gets a positive point if your age is between 18 to 61.

#2 Private Health Insurance

Your income standard, evidence of assets and resources, credit report score will be used to judge your financial status. DHS will consider it a positive point if you can pay for your own medical costs using your own income.

#3 Education & Skills

Your education, English language proficiency, skills and full time employment will count as a positive point for your profile.

Public Charge Bond

USCIS will add a bond of a minimum of USD $8,100 if they think you are going to apply for government services in the future. The bond amount may increase based on your situation and application details.

Applications for i485 will need to have form I-944 (Declaration of self-sufficiency). USCIS can deny the application even without issuing an RFE or NOID if the form I-944 or I-864 (Affidavit of support) is not attached to the i485 application.

Public Benefit Used By A Family Member?

You are safe as long as you have not used the public benefit yourself even if any of your dependent household members have used them.

Example:

You are working in the US on an H1B visa and your US citizen minor kid used public medical services due to their disability. The public benefit was extended on your name as the kid is a minor. You are still safe.

Public Benefits

- Any cash benefits for income maintenance

- Supplemental Security Income (SSI)

- Temporary Assistance to Needy Families (TANF)

- Supplemental Nutritional Assistance Program (SNAP)

- Most forms of Medicaid

- Housing Assistance under the Housing Choice Voucher (HCV) Program

- Project-Based Rental Assistance, and certain other forms of subsidized housing

Public Charge Exceptions

- Active duty or Ready Reserve component of the U.S. armed forces, and their spouses and children

- Certain International Adoptees and children acquiring U.S. citizenship

- Medicaid for aliens under 21 and pregnant women

- Medicaid for school-based services (including services provided under the Individuals with Disabilities Education Act) and

- Medicaid benefits for emergency medical services.

- Victims of qualifying criminal activity (U non-immigrants)

- Certain trafficking victims (T non-immigrants)

- Special Immigrant Juveniles (SIJs)

- Victims of domestic violence (VAWA self-petitioner)

- Humanitarian-based immigration programs for refugees, asylees

Source: Full text of Public Charge Rule