Once you file an i485 application, you become eligible for multiple benefits that are not available otherwise.

Filing the adjustment of status gives your non-immigrant kids an EAD and AP irrespective of whether the priority date (PD) date is current in the visa bulletin’s ‘Final Action’ or ‘Date of filing’ chart.

Here are the benefits.

This article will discuss:

#1 Child Tax Credit by IRS

H1B workers with non-US citizen kids used to receive child tax credit until the 2017 tax year.

With the new tax law (called Tax Cuts and Job Act 2017) passed by the Trump government, the child tax credit was restricted only to kids with SSNs.

Most non-US citizen kids on dependent H4 or L2 visas are not eligible to get SSNs. They all have ITIN which is not eligible for the child tax credit with the new tax law.

In this new tax law:

- The child tax credit was doubled from $1000 to $2000.

- The child’s SSN was made mandatory. Earlier, H4 and L2 kids with ITIN were also eligible for this credit.

#2 Job Change

Once your i485 has been pending for over 180 days with an approved i140, you gain additional wings to fly freely.

As per AC 21 law, you can change the job and the new employer can simply file form i485J to port your pending AOS application.

This also means that the new employer does not need to file their own PERM and i140 applications.

Isn’t it great?

You save the hassles of job scrutiny and easily save about 1-2 years of PERM + i140 processing time.

- I485 Pending (180+ days) and i140 approved: You are safe to change jobs but most attorneys recommend waiting for 180 days after the i140 approval date too.

- I485 pending (180+ days) and i140 approved for 180 days: You are safe. No issues as long as you change your job to the same or similar profession. As per general practical rule, the job duties in a new job should be at least 50% similar to the current job.

- I485 pending (180+ days) and i140 pending: It’s NOT safe to change the job before i140 approval. You will lose everything if the employer withdraws your pending i140. You can upgrade i140 to premium without an issue unless you have an H4 child that needs child age protection.

That’s a perk only offered to people who got the chance to file i485.

Will I need to file an H1B Transfer?

If you do not want to use i-485 EAD to work for the new employer, then yes, the new employer will have to file your H1B transfer and i485J supplement.

If you do use i485 EAD, then there is no need to file an H1B transfer.

Note that most people like to maintain H1B status just to avoid a situation where their i485 is denied in the future but this is not required by law.

Another situation where you may want to keep using H1B and not depend on i485 EAD is when you have filed EB2 to EB3 downgrade. Maintaining H1B will help you move from EB2 to EB3 and vice versa easily based on which queue is moving faster.

Most employers will be happy to hire you since your pending i485 gives them breathing space too.

Child EAD with i-485 Application

If you are eligible to file an i-485 even if the PD date is only current in the ‘date of filing’ chart in the most recent USCIS visa bulletin, we strongly recommend filing an EAD for your child irrespective of his/her age.

A child’s EAD helps you get the social security number for your child which in turn makes him/her eligible to claim a ‘child tax credit’ on your next year’s 1040 tax return.

This is a sample EAD card for category C09 (which is pending i485).

i-485 EAD card has category C09 and is allowed to get an automatic 6-month extension if the current one expires. This is unlike H4 and L2 EADs which do not get any automatic work authorization.

The child tax credit can be as high as $2000 per child based on your family’s taxable income.

The amount is reduced as your total household income increases.

Need Help File Application?

Support

Use hassle-free visa extension and EAD filing service to file your application with USCIS

Visa status issues consultation includedQuick Service

Filed within 1-2 days if you have all the documents ready and uploaded

Emergency service availablePhoto

You click, we edit photos as per US visa requirements to remove background, align face and shoulders

Photo printing includedThis can easily set off the attorney’s i-485 EAD filing fee if you are thinking of saving money there as your child does not intend to work anyway.

You can also file the i-485 EAD yourself as the i-765 EAD form is simple to fill.

Required SSN

IRS rules make it mandatory for your kid to have a ‘required SSN‘ to claim their child tax credit on the tax return.

IRS Publication 972 lists the child tax credit requirements.

The term ‘required SSN‘ means that the SSN should be valid for employment in the USA.

Does my child’s SSN pass “Required SSN” requirement?

Look at these cases:

#1 Child is a US citizen

If your child was a U.S. citizen when the child received the SSN, the SSN is valid for employment and passes the “required SSN” requirement.

#2 Child SSN card marked “Not Valid for Employment”

If “Not Valid for Employment” is printed on your child’s social security card, then your child does not pass the ‘required SSN‘ test.

If your child’s immigration status has changed so that your child is now a U.S. citizen or permanent resident, you have to get a new social security card without the legend to be eligible to claim the tax credit.

The Social Security office can issue you a new card.

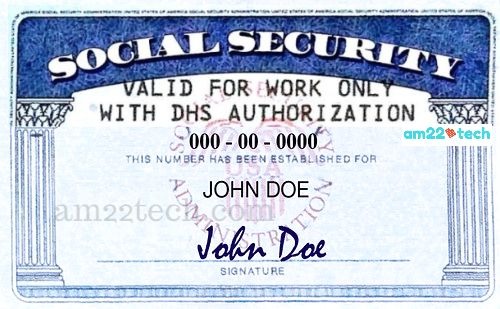

#3 Child EAD marked “Valid for Work Only With DHS Authorization”

If “Valid for Work Only With DHS Authorization” is printed on your child’s social security card, your child has the required SSN for as long as the DHS authorization is valid.

Most H1B, H4, L1, and L2 Social Security cards will have the annotation of “VALID FOR WORK ONLY WITH DHS AUTHORIZATION“.

This essentially means that a child can be claimed for the child tax credit as long as the EAD is valid.

Need Help File i-485 Application?

We can help you file your family's i-485 green card application for half the price charged by an Attorney. Get AM22Tech’s hassle-free i-485 filing service to file your application with USCIS.

Your application is filed within 1-2 days if you have all the documents ready and uploaded.

Your passport-size photos are edited and printed automatically. You just need to upload your photos online in our app and we take care of the rest.

You will need to get this “DHS Authorization” condition/label removed from your SSN card once you get your green card.

FAQ

You can apply for your child’s SSN and use it for tax filing purposes.

The EB2 to EB3 downgrade is not affected as long the kid uses the i-485 EAD for actual work and making money.