Have you used Robinhood’s stock lending? It’s a new feature that lets you give your stocks on loan thereby earning you interest.

I have been using it for the past 4 months and have the data to share with you.

This article will discuss:

Interest Payment

First things first, the amount you earn from stock lending is peanuts. It’s a very small amount that Robinhood pays you out of what they might be charging their client.

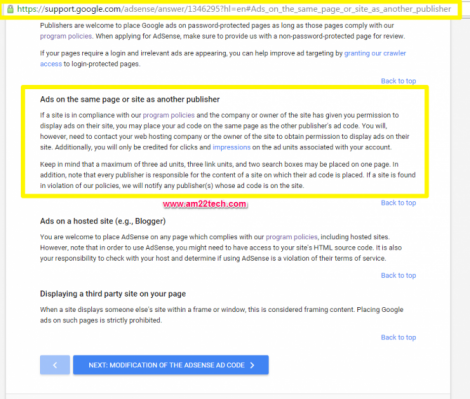

In the image below, the total value of stocks on loan at this time is $1,14,000. The interest amount paid is $17.50. This is around 0.00015%, which is really a low amount.

The total interest earned in 7 months from Jan 2023 to July 2023 is just $132.93. Of course, not all stocks were on loan and they vary each day and month.

They do not disclose how much they have received by lending your stock to the investors. The only documented amount that Robinhood shares is this:

To be eligible for Stock Lending, you’ll need to have at least $5,000 in total account value Or at least $25,000 in reported income. Also, you should not be a day trader.

How much stock lending pays for Amazon stock?

I am really disappointed to say that stock lending does not really pay anything for Amazon. I received 0.01 cents for Amazon stocks!

In fact, most stocks earn only $0.01 cent as the stock lending interest payment.

Major Financial institutions and other market players borrow stocks to clear trade settlements and short selling.

Normally, the stocks with low market availability and high demand are more likely to be borrowed.

Dividends on Stock Lending

The dividend is paid on the Stocks on loan but it is treated differently for income tax purposes by IRS.

The person or entity who has taken your stocks on loan gets the dividend from the issuer. This person will then pass on the full dividend to you as cash through Robinhood.

These payments are known as “cash in lieu of dividends” or “manufactured dividends.”

Robinhood’s brokerage statements will mark Manufactured dividends as “Manufactured Div.” instead of “Cash Div.”

Income Tax on cash from Stock Lending?

Note that since this is paid out as cash instead of dividends, cash is taxed as ordinary income.

You will simply add this amount to your total income and pay the normal tax rate.

The dividends on the other hand are taxed as per capital gain tax rules, which may be charged a lower tax rate.

Risks of loaned stocks

Loaned stocks are not covered by Robinhood’s SIPC insurance.

They simply protect the loaned stocks by keeping cash equal to the value of loaned stocks at a third-party bank. This bank would pay you the value of your loaned securities in cash if Robinhood filed for bankruptcy and couldn’t return your stocks to you.

Is it worth using Stock Lending?

In my opinion, I did not find the stock lending attractive given the amount it pays back as interest.

I would be paying a higher rate of tax on the dividends paid out on loaned stocks too.

Need Help File Application?

Support

Use hassle-free visa extension and EAD filing service to file your application with USCIS

Visa status issues consultation includedQuick Service

Filed within 1-2 days if you have all the documents ready and uploaded

Emergency service availablePhoto

You click, we edit photos as per US visa requirements to remove background, align face and shoulders

Photo printing includedHave you used the stock lending and have a different opinion? Do share it with us.