Avoid sales tax on Jewelry by ordering online from a shop that does not have a presence in your own residence state in the USA.

Sales tax on Jewelry is a big addition to the overall cost if you are buying Gold for Marriage from a hub like New Jersey or New York (NY).

This article will discuss:

Avoid Sales Tax on Jewelry

You can avoid paying the 6%+ sales tax if you are okay with getting the ornaments shipped to you out of state at your home or business address.

Most state’s law says allow Jewelry shop to not collect sales tax on the out of state purchases. This is possible if they do not have a registered business in the package’s destination state.

Hence, you can use this trick to completely avoid paying the sales tax on your bridal engagement ring.

For example:

You avoid sales tax on diamonds by buying it from New Jersey and shipping it to Massachusetts residence address.

You don’t pay sales tax either to New Jersey or Massachusetts in this case.

Amazon Jewelry Purchase

Many jewelry sellers on Amazon do not charge sales tax just like other companies who sell gold or diamonds online.

But, beware, the precious metal bought from most Amazon sellers is subjected to state tax now due to Amazon’s registered business in all US states.

I strongly suggest checking your Amazon shopping cart before finishing checkout to make sure no sales tax has been added.

Did you know that you can create Amazon Wedding Registry and both the bride and groom can get a 20% discount?

Example:

This 18K engagement ring on Amazon store Anazoz does not add sales tax even though the shipping address is in Massachusetts and billing is from Texas address.

Buy from a Zero Sales tax State

There are 7 states in the USA that do not charge sales tax. Isn’t it unbelievable? Yes, it is.

Delaware, Montana, Oregon and New Hampshire have a policy of not adding burden of sales tax on consumers.

If you are living in these states, you are already lucky. If you are shopping in these states, you can expect to pay no sales tax on your engagement ring.

Note: These days, state governments are trying to make it mandatory for online retailers to charge sales tax on out-of-state sales too. We will update once it happens.

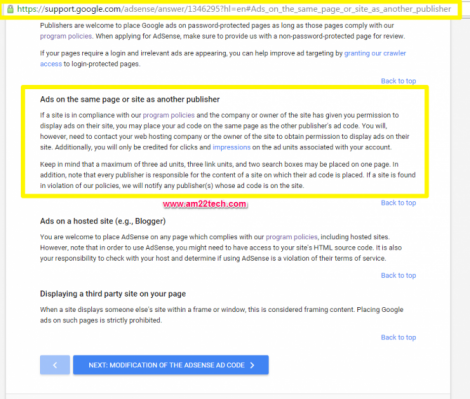

Use Tax

Even though your residential state may not know if you paid sales tax on a purchase you made out of state, most of them have the concept of ‘Use Tax‘ that makes you liable to pay it.

The Use Tax rate is mostly charged at the same rate as the sales tax rate in your State.

Although it is required to be paid with your state tax return filing at the end of the year in good faith, there really is no tracking done that we know of.

Also, if you paid in cash for your outside-the-state purchase, there is no tracking possible whatsoever.

If you are using online tax software like e-file, TaxAct, H&R Block or TurboTax, you can also pay a lump sum use tax calculated by your state as ‘use tax’ if allowed by your state.

This lump sum use tax will bring you on the safe side irrespective of how much sales tax you have saved.

Need Help File Application?

Support

Use hassle-free visa extension and EAD filing service to file your application with USCIS

Visa status issues consultation includedQuick Service

Filed within 1-2 days if you have all the documents ready and uploaded

Emergency service availablePhoto

You click, we edit photos as per US visa requirements to remove background, align face and shoulders

Photo printing includedExample:

From our earlier example, you don’t pay sales tax but you still have to pay the MA use tax.

The use tax applies because the diamonds were not subject to a sales tax in the other state and because it’s for use in Massachusetts. Unlike the sales tax, the buyer generally pays the use tax directly to Massachusetts.