|

Listen to this article

|

Car Insurance is mandatory and one of the major monthly expense for families in the USA.

You should understand that only Liability insurance is mandatory as far as law is concerned. Insurance companies try to sell you comprehensive insurance which includes many things that you may never need.

I will explain what part of the car insurance premium can be saved based on your personal usage while evaluating quotes from Geico, Progressive, Amica, Liberty Mutual, and more.

There are multiple car insurance apps that aggregate quotes from multiple companies. They are basically earning a commission as an agent.

This article will discuss:

How I Saved my Monthly Car insurance?

I just went back to buying only liability insurance for about $46 per month for a car worth $50,000.

The comprehensive cover was costing $100 per month for a car that had features safety features like:

- Automatic Braking to avoid Collision – both front and back

- Radar Controlled adaptive cruise control

My mind simply did not accept the cost of insurance when compared with the probability of an accident to cover the loss.

Hence, I just got rid of all the extra packages from the insurance and saved on insurance.

IMPORTANT

You should take into account your own situation and take the decision to remove the comprehensive coverage if you feel confident about it.

I was confident that I will be able to cover any damage to my car out of my pocket, if required in worst case.

If you do not have the savings to cover your car loss, then, it is always better to have comprehensive coverage so that you can claim it from insurance provider.

Contrarian Thinking

I invest the saved premium per month into S&P 500 and let it grow.

The way I see it is that I am providing insurance for myself by investing the money in stock market.

In case of any collision or accident, I will take the money out from my S&P investment to cover the car loss, for which, the probability is very low.

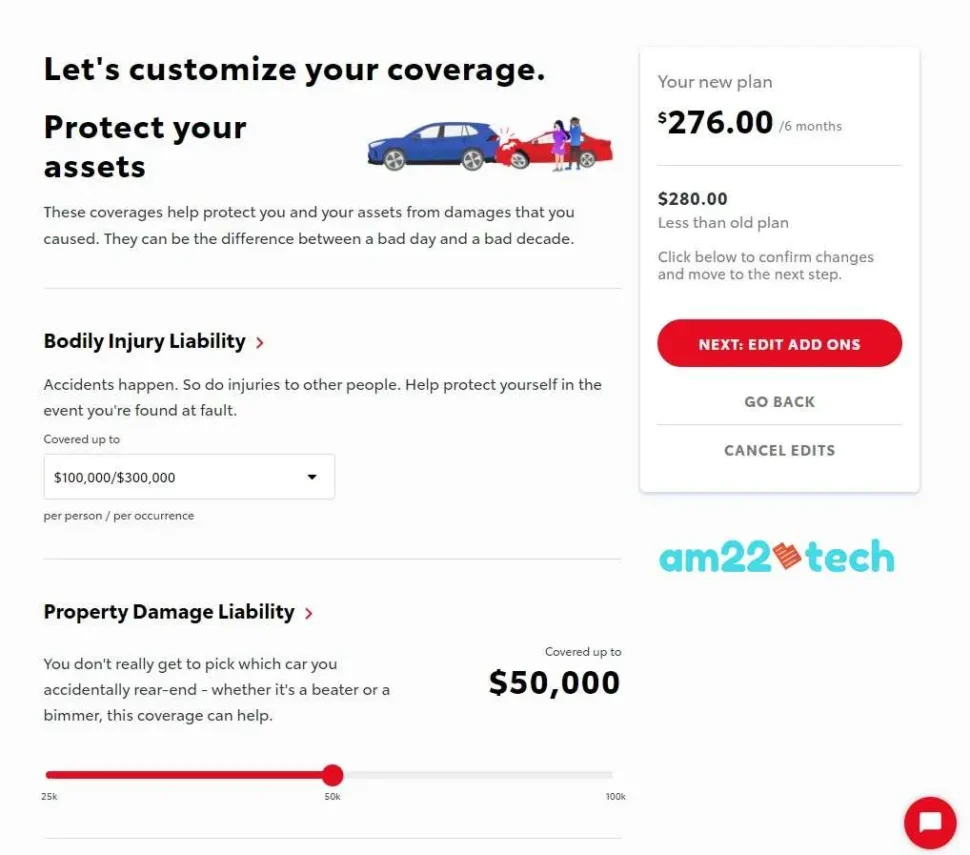

#1 Liability

Car liability insurance is mandatory in the USA and controlled by state laws. This is required to pay to cover the damage caused to other vehicles if you hit them.

This minimum basic insurance is also required at the time of car registration.

Liability has two sub-categories:

- Bodily Injury

- Property Damage

Each state in the USA has a different minimum required level for each part of Liability coverage.

Example:

Texas law requires you to have at least $30,000 of coverage for injuries per person, up to a total of $60,000 per accident, and $25,000 of coverage for property damage. This is called 30/60/25 coverage.

How Much Liability is Enough?

I recommend buying at least 3 times more than the state minimum values. In our example for the state of Texas, you should buy:

Need Help File Application?

Support

Use hassle-free visa extension and EAD filing service to file your application with USCIS

Visa status issues consultation includedQuick Service

Filed within 1-2 days if you have all the documents ready and uploaded

Emergency service availablePhoto

You click, we edit photos as per US visa requirements to remove background, align face and shoulders

Photo printing included- $90,000 for Bodily Injury and (I chose 100,000/300,000 for myself)

- $75,000 for property Damage (I chose 50,000 for myself)

You can expect this 3 times the state minimum amount liability coverage for 1 car with 2 drivers at about $55 per month if you have good driving history.

Your driving history in the USA starts with your first license. That’s why I have suggested getting a driving license within a week of landing in the USA if you are an international student or a skilled visa worker like H1B or L1.

Is 3 Times the Minimum State Enough?

Liability cover of 3 times the state minimum may not be enough but is good enough to cover the cost of total loss for an expensive car like Mercedes, BMW X5 or Tesla.

People in the USA claim or sue you based on your capacity to pay back.

Your Insurance company also fights back or try to negotiate out-of-court in case of a claims.

They do not simply just pay whatever has been asked by the other party.

Find Probability of Accident – Your Driving Style

If you are extra cautious, buy a cover for 6 times the minimum or may be 10 times the minimum based on your own risk analysis of how bad you drive and the chances of you hitting someone on the road.

I usually just drive on weekends for short travel to malls or grocery stores and that too in a car with so many features to avoid a collision automatically.

So, my opinion of me hitting a car was the same as hitting a tree while walking. In other words, just a 10% chance of hitting another vehicle.

So, I chose to cover that 10% risk with 3 times the minimum state values.

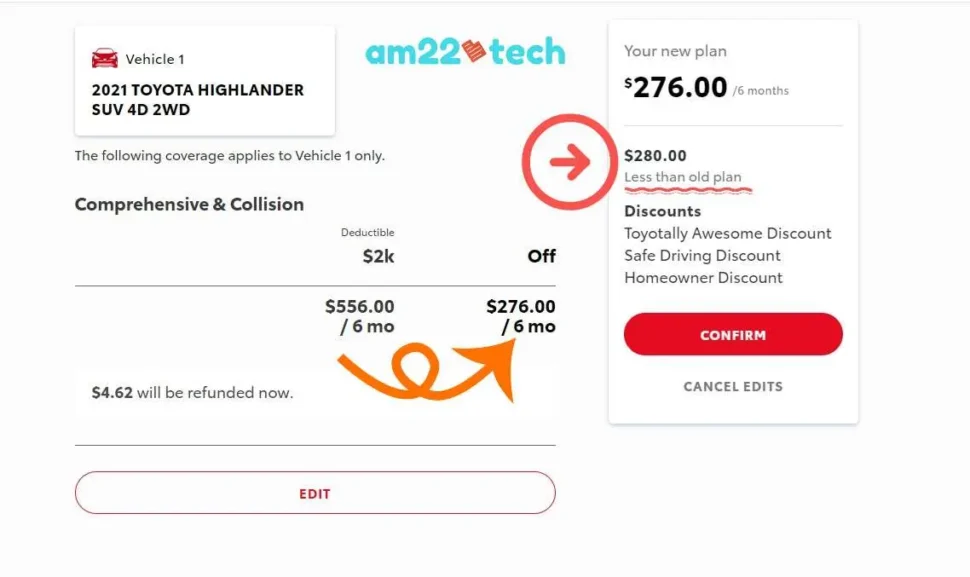

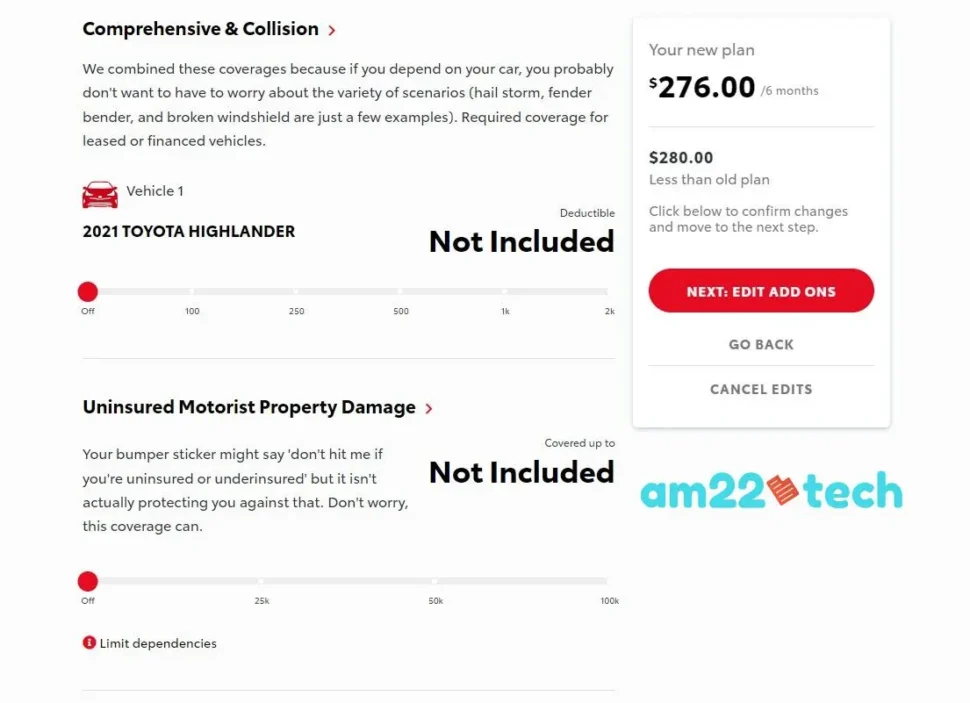

#2 Collision – Damage to Your Auto

US car insurance companies sub-divide into two parts:

- Collision pays to repair or replace your car after an accident

- Comprehensive (other than Collision) covers flood, theft, vandalism, riots, tree fall, Tornado, Hail, and other such damages caused while the vehicle was not moving.

This is one of the most expensive portion of car insurance.

Collision insurance is required if you have bought your car with a bank auto loan or on lease. Lease is even higher than auto loan.

Your finance company will make it mandatory to buy the full collision coverage to cover themselves.

Should I buy Collission Coverage?

- I suggest not to buy collision if your car’s current worth is less than USD 15k.

- You can cover the damages to your own car if you hit someone. If the other person hits you, their liability insurance will pay for your car’s losses.

- If you have paid off your car loan, you can avoid paying high costs of collision.

- If you park your car in a garage, the ‘comprehensive – other than collision’ coverage is pretty much useless. You can avoid it.

I completely avoided buying car collision insurance as I started contributing $100 a month into a so-called car emergency high yield savings account instead of paying it to the insurance company.

This way, if there was any requirement like a windshield repair, I would use my savings from this car emergency repair fund.

If there was no damage (chances are good), I would have saved that money and earned interest too.

#3 Medical Payments

Medical payments from your car insurance pay for your own injuries in case you get into an accident on US roads while driving your car.

The medical coverage here is mostly too low to make any significant difference.

I suggest using your Health insurance coverage in case of need as that would have more comprehensive coverage.

Should You Buy ‘Medical payments Coverage’?

- Medical payments insurance is NOT mandatory. You can choose to not buy it.

- Buy it if your health insurance does not have accidental coverage. You need to read the fine print to check this.

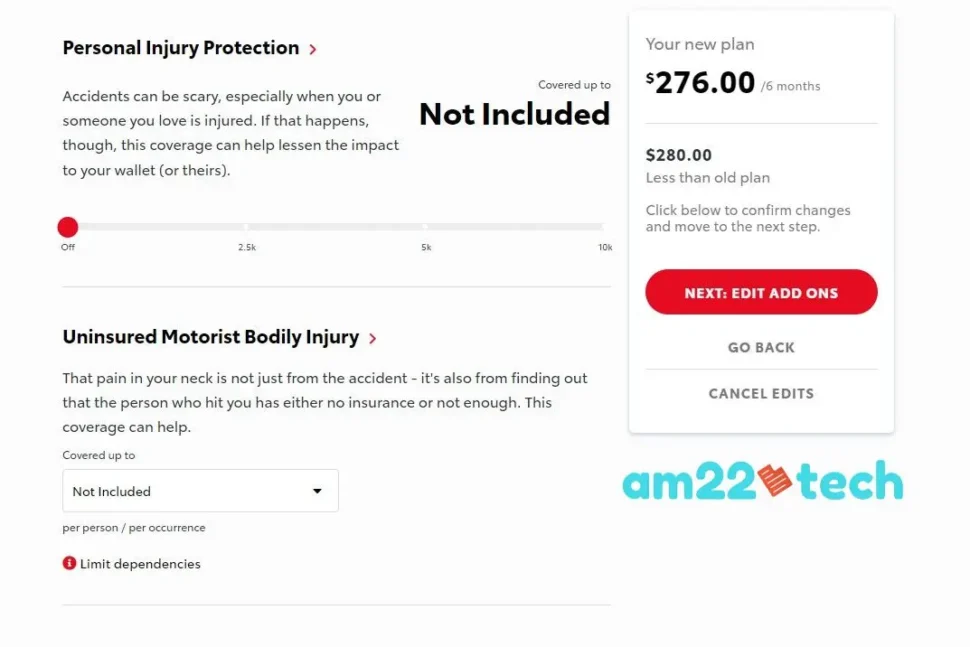

#4 Uninsured Motorists

If you get hit by a car and the other person had no insurance, you will get covered by your own insurance with ‘Uninsured Motorists hit coverage.

The probability of getting hit is really low and that too by someone who has a car with no liability insurance is extremely low.

Almost all cars on US roads have at-least liability insurance which protects you in case they hit you. It has two sub-categories:

- Bodily Injury

- Property Damage

Both subcategories cover only your own personal injury and damage to your own car.

Should You Buy ‘Uninsured Motorists’ Coverage?

- You are not required to buy this insurance if you are fine with taking the loss by yourself as the probability of getting hit is too low.

- If you work from home, my suggestion is avoid ‘Uninsured Motorists’ cover as your chances of getting into this situation are less than 10%.

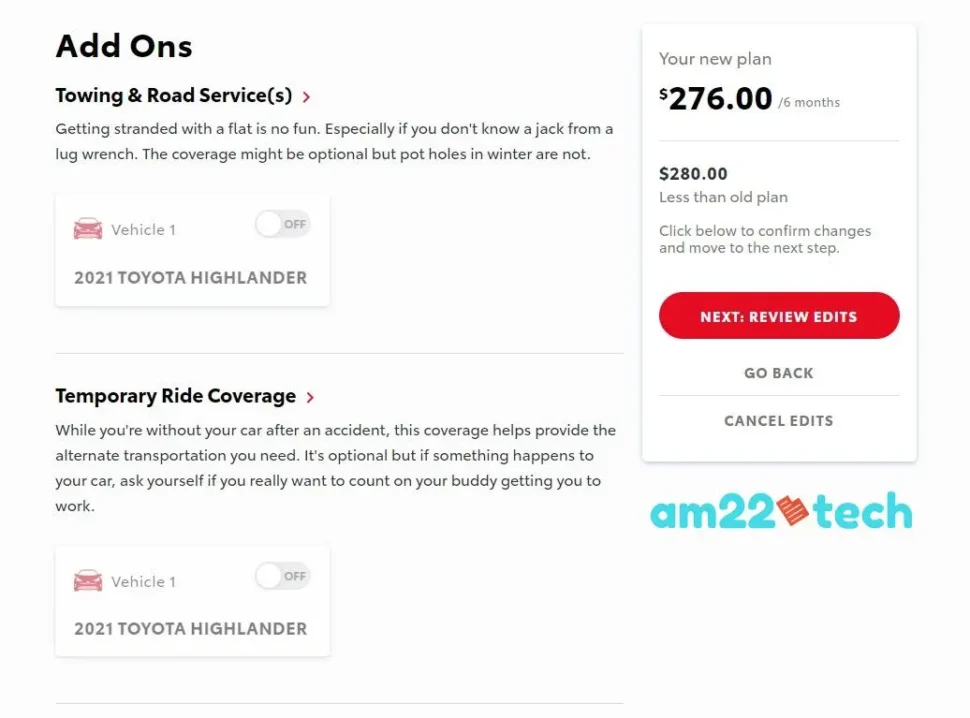

#5 Towing and Labor

Car towing and labor does not cost much. This covers the towing and labor cost if your car cannot be driven after an accident.

Should You Buy ‘Towing and Labor’ Coverage?

- I suggest to leave it out as most of the new vehicle purchases are covered for free roadside assistance by car manufacturers themselves. For Example, Honda, Toyota, Hyundai, Nissan and Ford have free roadside assistance programs.

- If you want to buy this coverage, buy it from third party roadside service like AAA than buying it from the car insurance provider. AAA has a much bigger network and offers discount programs too.

#6 Rental Car Insurance

You get a rental car for the period your car is in collision repair center.

Your insurance company will pay for your car rental expenses. Note that only a certain amount per day up to a maximum limit is covered based on your coverage.

Should You Buy ‘Rental Car Insurance’ Coverage?

- My suggestion is to use Uber / Lyft / Waze rides these days if required instead of buying rental car coverage.

- The chances of getting into an accident are lower and then using rental for the period of repair is even lower. If you do need a rental car, you can get it from the open market and pay for it as and when you need it. There is no need to keep paying a fixed monthly amount for a service that you may not use at all.

FAQ

Car insurance rates for immigrants, international students, and visa workers may be high in the first 2 years in the USA.

Most F1 students, H1B or L1 visa workers get a car insurance rate quote of about $400 per month when the car’s monthly EMI may just be less than $300 per month.

The car insurance company considers your zero driving history in the USA to be equivalent to a teenager in the USA.

I strongly advise to get driving license as soon as you enter USA to start building driving history even if you do not buy car immediately.

You can use your international driving license and history to reduce your premium in the USA.

Car insurance sales agents may not tell you this directly but your driving license and history from your own country like India, China, etc. can be counted to reduce your insurance premium.

The general rule followed by companies like GEICO, Amica, Liberty Mutual, progressive, etc is to check your last 6 years of car driving history.

You may not find the option of showing international history using online car insurance quotes.

The online car insurance quote usually does not have the option of giving your driving history from the home country.

You should call the customer service to claim and get the benefit.

If the customer care executive refuses, I suggest calling a local car insurance agent in your zip code. They know how to add your home country driving history to your quote.

You won’t believe but just using your own country’s driving license will reduce your car insurance monthly premium by HALF!

This is really true.

When I got my first car insurance in the USA for Honda CRV base model (bought for $24,000), I was quoted $450 per month by Liberty Insurance. My car’s monthly installment was just $371.

This was a ridiculous amount. I called a local agent and he added my Indian driving history of more than 10 years by uploading a copy of my Indian driving license.

He brought down my insurance quote to $90 per month with a local insurance company named Plymouth Rock Assurance.

Your car insurance premium can increase on the next renewal if the insurance company had to pay for the damage.

I know many people who opened their car door and the heavy wind resulted in hitting another car that was parked in the next spot.

The damage claim had resulted in a $400 payout by the insurance company.

In these kinds of cases, most people try to negotiate and pay the cash to settle the dispute instead of going to the insurance company. This helps avoid a crash report record on your insurance history.

A DUI will definitely affect and increase your car insurance premium.

I strongly recommend to use Uber Taxi instead of risking your life and then paying the costs of high premium along with a DUI ticket cost.

A DUI ticket given for driving under influence of drugs of alcohol beyond approved limits (varies by state law) is considered a very serious offence.

International students F1, H1B, L1 visa, H4, and others can be denied visa at US embassy interview.

Your chances of Green card approval also reduce drastically with DUI ticket.

The car Insurance company does pay for the damages after an accident, but, eventually recovers them from your pocket by raising your monthly premium.

If you happen to be living in an area affected by any natural calamity like hail damage or a snow damage or a tornado, you would see that your car insurance premium is increased even when you never claimed anything.

Insurance companies increase the premium for the whole zip code if they have to pay out a large number of claims in that zone.

Low Cost Car Repair – No Insurance

This is an example case scenario to understand how you can handle the costs of repair if you decide to buy only ‘liability’ insurance.

You own a new Honda CRV (bought for $24k).

#1 Worst case – Total Loss

Maximum total loss i.e. 24K – You are ‘At Fault‘.

With liability insurance, the other party’s claim will be paid by the insurance company and you will need to pay for buying your OWN new car to replace your total loss car.

#2 Average case – Repairable Dents

Third-party car damage will be covered by Liability again. You will be required to pay for your own car’s fixes.

You can choose to shop around and even get it done by a local garage as their rates are much lower than car manufacturer’s own service centers.

You won’t believe but 90% of the car dealerships also just outsource the collision work to that local garage themselves including Honda, Toyota, and Nissan.

#3 Best case – Glass Damage

In most cases, you might have opted for a higher deductible for glass damage in the rage of $500 per instance.

If you shop around, the total cost of aftermarket glass replacements only costs around $500-600 anyway including labor!