|

Listen to this article

|

Many states in the US like Texas and Georgia allow real estate cash back legally. Many people have asked me if this cashback is taxable and should it be shown on their annual US 1040 tax returns.

The good news is that the agent cash back after closing in the US is not taxable in your hands. You can safely keep the full amount and use it to buy furniture for your new home.

This article will discuss:

New Construction Home 5% Cash Back

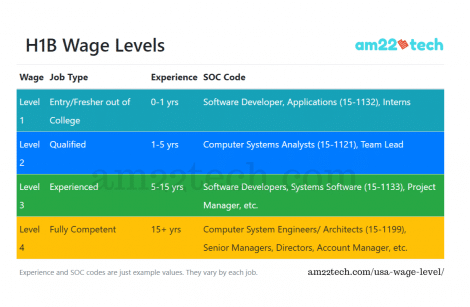

New construction property 5% cashback is popular with H1B workers and is normally offered by agents in high-competition markets such as Dallas.

The incentive is given specifically in new homes as the agent does not have much to do in the deal between the buyer and the developer.

- A buyer would normally just look at a newly constructed home, make a buying decision, and involve the real estate agent at the time of signing the sale contract.

- The agent would receive a 3-5% sales commission from the builder and then would pass on the whole amount to the buyer by just keeping about USD 1000 as his own cost.

Real estate agents in Atlanta also do the same because they can get good revenue even if they just keep 1k for every sale and that too without doing anything in the wholesale transaction. It is not common in some states like Massachusetts.

Real Estate Agent Issued Form 1099-MISC

As per Turbo Tax, you do not need to worry even if the agent has issued you form 1099-MISC as real estate commission rebates are not taxable income.

Turbo tax suggests that you should ask for a corrected 1099-MISC from your real estate agent to avoid paying tax on your 1040 return. In-home purchase money-back program, there is no 1099-MISC required.

The other tax filing software or companies like e-file, freeTaxUSA, and Liberty Tax, HR block should also help you save tax on real estate commissions too.

Note that Indian bank NRO, NRE interest is taxable in the US even though Indian bank does not issue form 1099-INT.

IRS Rule for Property Purchase Cash Back

IRS had clarified that any cashback received from a developer or real estate agent is not taxable as it is a rebate that you received on a purchasing price.

Example:

- You purchased a home directly from a builder like Landon Homes in Dallas for $500k.

- There is a broker who sent you a cash-back check of $24k, which is roughly 5% commission after keeping 1k as his own commission.

This cashback is considered a rebate (or credit) by the IRS and hence is not taxable on your 1040 return.

As per IRS, down payment assistance received by a home purchaser represents a rebate or an adjustment to the purchase price, and, as such, is not included in a purchaser’s gross income.

Similarly, if you buy or lease a car with a manufacturer cashback rebate, you do not include it in your gross income on a 1040 tax return. The rebate is considered an adjustment to the purchase price of the automobile.

Should Agent Issue 1099-MISC?

As given in the IRS ruling, your real estate agent is not required to make a return under section 6041 of the Code for payments as these payments are not considered your (home buyer’s) income.

Your real estate agent should not be filing any IRS reporting forms for cashback.

The broker should reduce the cashback amount from his gross income while filing his own income tax return.

FAQ

Real estate agent cash back is not taxable in the US.

The buyer’s real estate agent is not required to issue 1099-MISC for cashback payments.

You should ask your agent to withdraw the Form 1099-MISC if they have issued it.

If your agent is not ready to withdraw the 1099 MISC for cash back, then you can show it on your tax return and claim that it is not taxable.

You would need to prepare a paper-based return. You cannot e-file if you have this 1099 MISC from the broker that needs to be negated.

Do not add the 1099-MISC income on your 1040 return.

Attach a cover letter explaining why this cashback (1099-MISC) is not reported by including a copy of the above IRS ruling.