|

Listen to this article

|

The cost of shipping the iPhone from the USA to India is $150+. The GST tax is 18%.

Buying the iPhone from the USA and shipping it to India is not cheap after adding customs duties and GST tax.

Indian government charges customs duty on importing phones from China, the US, Canada, the UK, or Australia.

You have to pay for shipping, insurance, and customs duty in India along with GST tax for sending any phone including iPhone, Google Pixel, Samsung Note, and Samsung S series to India.

You may be paying much more for a smartphone if you decide to buy from the USA and ship it to yourself in India, the legal way.

This article will discuss:

Custom Duty, Taxes in India

Indian Customs duties and GST tax are due when you import mobile phones under the cell phone category.

Indian customs will find the CIF value for the iPhone or mobile that you are importing to India.

The CIF value is a total of:

- the price paid for the goods (including sales tax) +

- the cost of transportation +

- loading, unloading, handling fee +

- Insurance fee +

- any other fee you pay for the delivery of goods from the place of export to a place of import

All other charges are calculated on this CIF value.

Example:

| Buying in USA | Price |

|---|---|

| iPhone Base Price | $1200 |

| Sales Tax (8% average across US) | $96 |

| FedEx Shipping fee (door to door) | $150 |

| Insurance fee (if you pay extra for insuring your phone – Usually 2% of product value) | $24 |

| TOTAL (CIF VALUE) | $1470 |

| GST (18%) in India | $265 |

| FINAL COST (CIF + GST) | $1735 |

In our example, this CIF value is the total money that you have spent on the item in the USA including all sales tax.

If you convert the dollar amount to Indian rupees with a conversion rate of 1 USD = INR 83, it probably makes no financial sense to ship it.

It would probably cost around 144k Indian rupees (equal to $1735) to send it to India.

Instead, we would suggest buying directly from India.

iPhone Global Warranty

Apple does offer a global worldwide warranty on its products bought in the USA.

This means that Apple’s official store in India should be able to help you fix or replace the iPhone in case it stops working within 1 year from the date of purchase (receipt date).

Apple’s warranty says they will:

- Repair the hardware defect at no charge, using new or refurbished replacement parts, or

- Exchange the product with a product that is new or which has been manufactured from new or serviceable used parts and is at least functionally equivalent to the original product, or

- Refund the purchase price of the product. Apple may request that you replace defective parts with new or refurbished user-installable parts that Apple provides in fulfillment of its warranty obligation.

Send Locked iPhone

You will also need to make sure that you send the unlocked iPhone to India or you will need to find someone who can unlock the iPhone for you.

Unlocking can be done but it sometimes results in making the phone unusable. So, be very careful.

Many people buy the iPhone from service providers like ATT, Verizon, and T-Mobile with insurance and then send it to India.

They then, claim the insurance for the lost iPhone and try to get a new one.

- First, this setup is illegal as per US law as it is considered fraud with insurance companies.

- Second, the insurance companies have become smart and they have now added a co-pay and the deductible to make sure you do not get any such ideas.

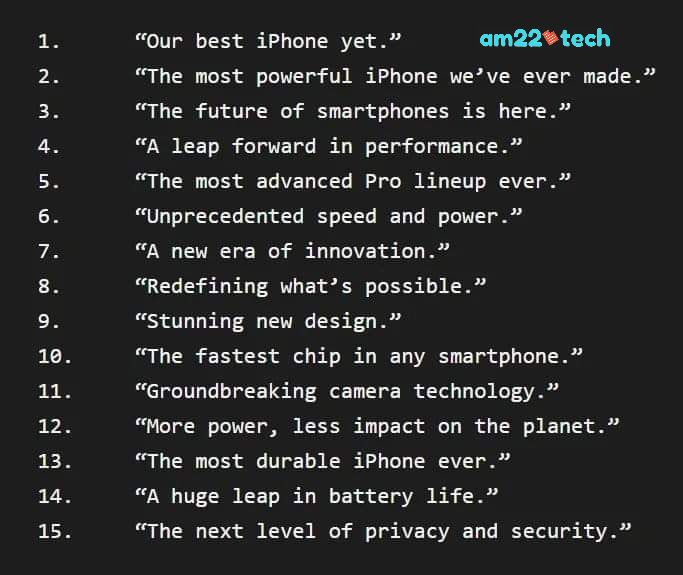

Someone recently shared this picture of an Apple launch event with me which sums up the need to upgrade to a newer iPhone every year!

FAQ

Any person can send a mobile as a gift to India. It can be your business associates, friends, relatives, or companies abroad can send a mobile as a gift to India.

No relationship proof is required.

The Indian receiver is required to pay the customs duty and taxes on imported mobiles.

Need Help File Application?

Support

Use hassle-free visa extension and EAD filing service to file your application with USCIS

Visa status issues consultation includedQuick Service

Filed within 1-2 days if you have all the documents ready and uploaded

Emergency service availablePhoto

You click, we edit photos as per US visa requirements to remove background, align face and shoulders

Photo printing includedYou can pay iPhone custom duty yourself at the airport or your shipping company can pay and then you can pay them.

When the shipment reaches India, your postal company like FedEx will run it through customs. The customs officer would create a custom invoice and the postal company would either call you to keep the money ready or ask you to deposit the money first.

Once you deposit the money, you will be handed over your package. Most of the companies these days like BlueDart, FedEx, etc. have streamlined the process.

They would call you before coming to deliver the package and ask to keep the money ready. You pay the customs duty to the delivery boy itself.

The mail company can take 3 to 10 days to deliver your mobile from the USA to India. There can be delays caused by customs checking in India.

GST tax is applied to imported mobile phones in India including the iPhone.

GST is a short form of Goods and Services tax.

Sales tax is not charged on imported mobile phones in India.

You cannot avoid Indian customs duty by marking the mobile package as a gift when shipping to India.

Only gifts up to INR 10,000 worth of a single package are allowed as custom-free in India.

The value of 10K is converted value after applying the USD to the INR exchange rate. Postal charges or air freight or insurance is not taken into account to find the value of the product.

NOTE: If the value of the gifts received is more than INR 10,000, the receiver has to pay Customs duty on the whole consignment, even if the goods were received free.

You have to pay customs duty on a mobile phone while receiving it in India even when you win it in any online competition or lottery or anything.

You can carry the new iPhone in your pocket but custom duty is required to be paid if the total value is greater than 10,000 Indian rupees.

You can carry a mobile but if you do not declare it on the customs form, you may have to pay a penalty if you are caught.

If you are not caught by customs and you did not declare it on customs forms, you have escaped the duty effectively.

You have to pay an 18% GST tax on imported mobiles in India.