India

India customs duty for mobiles, Indian income tax, finance, and home loans.

Indian salary calculator, increasing salary and tips to buy home.

Passport renewal, Police clearance certificate for immigration to the US, Australia, Canada, and the UK.

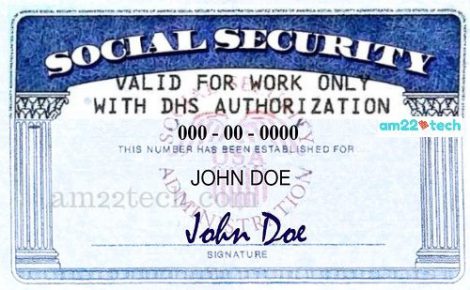

Will Social Security Benefits be Paid in India / Canada If I Leave USA?

Anil Gupta

19 Aug, 24

19 Aug, 24

Can You Use Robinhood in Canada/India? How to maintain US 401k account?

Anil Gupta

14 Aug, 24

14 Aug, 24

Can US Citizen Kid Sponsor H1B Parent’s Green Card at Age 21?

Anil Gupta

13 Aug, 24

13 Aug, 24