This is my own experience of sending a used smartphone by postal mail from the USA to India with USPS (United States Postal Service) as the shipping company.

You can easily send any used or new mobile phones like iPhone, Google Pixel, or Samsung note or Samsung mobile from the USA to India.

Calculate India Customs Duty Now

This article will discuss:

Mobile to India Custom Duty and GST Tax?

GST Tax is charged on imported goods including mobile and is part of customs duty.

The most updated GST rate is mentioned in this article for mobiles.

Sending Mobile to India by USPS with Fedex delivery

Which mailing service is reliable, cheap, fast, and offers custom clearance in India?

- FedEx is most expensive with the cost for 1 LB package around $116.

- UPS has price tagged at $109.

- USPS starts its pricing from $61.45 for priority mail international.

The biggest drawback with USPS though is that they use India Post as their delivery partner in India for all their priority mail international services. It takes about 7-10 days with NO custom clearance help.

USPS Global Delivery Express Service

Most of the people would use the USPS priority mail service but I would not recommend it. Instead, use USPS’s other product named ‘Global Delivery Express’. This service uses FedEx delivery in India. FedEx India takes the pain of custom clearances on your behalf.

USPS Global Delivery Express costs $108.80 with insurance, tracking, and 3-5 day guaranteed delivery in India (They use FedEx to deliver in India instead of India Post).

I know that it is almost the same price as UPS and a bit less than FedEx. But, you don’t have many options if you want reliability, custom clearance help, and faster service.

Even if you have time to spare and don’t care about speed, I would still strongly recommend using this USPS service.

Here is the custom form and sample receipt for sending via USPS service:

Then, the final mobile box would be placed in USPS-Fedex packet like this:

Documents to Send for Indian Custom Clearance

You need to pay customs duties and taxes when a smartphone bought in the US reaches India.

Don’t worry, you will get a call from FedEx India where a delivery boy will contact you immediately with the documents that you need to furnish. In our case, the FedEx delivery person hand-delivered the list of documents to be submitted with instructions on the 3rd day itself and that too after 5 PM.

You can pre-prepare yourself and collect these documents, to expedite the customs clearance. Note all the documents here should be of the person receiving the package in India.

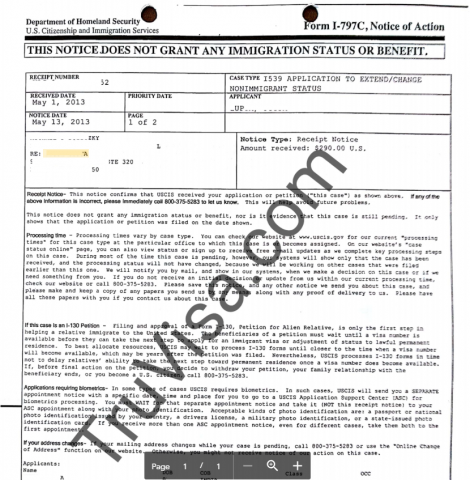

This is the letter you can expect you receive when your package reaches India and USPS hand-overs it to them:

- 2 Passport Size photograph. If you are sending documents by email, just send one digital copy.

- PAN card copy.

- Anyone of the following:

- Voter ID card

- Passport’s first and last page

- Driving License

- Bank Statement

- Ration Card

- Aadhar Card

Documents From Indian Receiver

Download the KYC Form (Know Your Customer Form) and Authorization Letter from this FedEx India link under section ‘Useful Shipping Forms at Your Fingertips‘.

KYC form has the ‘Checklist’ included in one single download.

#1 Fedex KYC form (sample)

#2 Fedex Checklist (Sample)

#3 Fedex Authorization Letter

For getting your package cleared by Fedex on your behalf

You can easily send the KYC form, checklist, and other scanned copies of documentary proof by email [email protected] with the subject as your FEDEX AWD number.

Fedex AWD Number

Need Help File Application?

Support

Use hassle-free visa extension and EAD filing service to file your application with USCIS

Visa status issues consultation includedQuick Service

Filed within 1-2 days if you have all the documents ready and uploaded

Emergency service availablePhoto

You click, we edit photos as per US visa requirements to remove background, align face and shoulders

Photo printing includedYou will find the FedEx AWD number on the top of the document demand letter. See the sample above.

Remember, this is NOT the same as the USPS tracking code that you would have got in the USA.

Custom Duty, GST Tax in India

Here is the break up for this case:

This custom duty percentage keeps changing from time to time as the government revises the tax rate. When I had shipped it, there was no GST tax applicable.

But, now, the GST tax rate is charged. The current custom duty and the tax rate is documented here for your easy reference.

CIF cost means the total of Cost, Insurance and Freight.

The CIF value is the price paid for the goods plus the cost of transportation, loading, unloading, handling, Insurance, and associated costs incidental to the delivery of goods from the place of export to a place of import.

This is precisely the value that customs values your imported item. The other charges are calculated on this CIF value.

You would need to pay these fees (INR 2399) at the time of delivery to the FedEx person by CASH. They will provide the receipt too (as shown above) with your package.

Cost of Sending Used Phone to India

| Custom Duty India | Google LG Nexus 5 (16 GB) White |

| Declared Price (in USD, has to be greater than zero) | $50 |

| Package Weight | 11 Oz (Less than 1 LB) |

| Mailing Cost (USPS Global Delivery Express) | $108.80 |

| Transit Insurance (FREE up-to $100 declared value) | $0 |

| Total (in USD) | $158.80 |

| Total (in INR)(1 USD = INR 66.88) | INR 10,939 |

Add to this, the cost of customs duty as charged as you can see the final hit to your pocket.

You cannot save Indian custom duty by marking the parcel as a gift.

You can ONLY gift up-to INR 10,000 worth of a single package and that too without a bill.

The value of 10K is converted value after applying the relevant exchange rate. Also, postal charges or air freight or insurance are not taken into account to find the value of the product.

If the value of the gifts received is more than INR 10,000, the receiver has to pay Customs duty on the whole consignment, even if the goods were received free.

Any person abroad can send gifts to India.

There is no specific restriction that only relatives can send the goods. Business associates, friends, relatives, companies, or acquaintances can also send gifts to residents in India.

No proof is required.

This service by USPS (with FedEx) takes about a total of 3-5 working days if there is no customs clearance delay.

If you are submitting the KYC and supporting identity proof documents for the first time to FedEx, there will certainly be a delay of at least 2-3 days.

There is no sales tax charged by India on importing goods at this time.