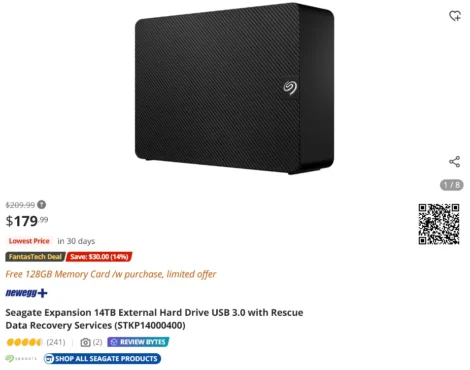

Seagate 14TB External Drive at $179.99 for Home back up NAS is best value per TeraByte

Anil Gupta

15 Jul, 24

15 Jul, 24

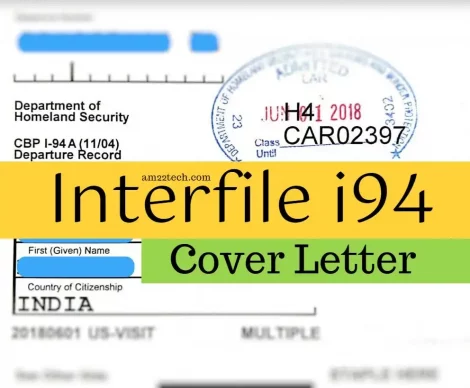

Send New H4 i94 to USCIS for EAD Auto Extension? (Interfile Cover Letter)

AM22Tech Team

2 Jul, 24

2 Jul, 24